As the world of finance anticipates the tesla split buzz anticipated stock split in 2024, investors and market enthusiasts are abuzz with excitement. Tesla, Inc., known for its innovative approach to electric vehicles and its charismatic CEO Elon Musk, is again making headlines with rumors of a potential stock split. This speculation has gripped the financial community, leading to discussions about its possible implications for both the company and its investors.

Tesla's previous stock splits have been significant events, impacting stock prices and market dynamics. As we delve into the tesla split buzz anticipated stock split in 2024, it's essential to understand the context and the factors that drive such corporate decisions. Stock splits can make shares more accessible to a broader range of investors, potentially increasing liquidity and market participation. However, they come with their own set of challenges and consequences.

In this article, we will explore the potential impact of the tesla split buzz anticipated stock split in 2024 on the market, the reasons behind Tesla's decision, and what investors can expect. We will also examine the historical context of Tesla's stock splits and how they have influenced the company's market position. From financial analysis to investor sentiment, we'll cover all angles to provide a comprehensive understanding of this highly anticipated event.

Read also:Drake With Braids A Stylish Transformation Thats Turning Heads

Table of Contents

- A Brief History of Tesla's Stock Splits

- What is the Financial Impact of a Stock Split?

- How Do Stock Splits Affect Investor Sentiment?

- Why is Tesla Considering a Stock Split in 2024?

- How Might the Market React to Tesla's Stock Split?

- The Pros and Cons of Tesla's Stock Split

- A Guide for Investors: Navigating Tesla's Stock Split

- Analyzing Historical Stock Splits: Lessons from Tesla

- What Do Experts Say About Tesla's Stock Split?

- How Does Tesla's Stock Split Compare to Other Companies?

- Future Projections: Tesla's Market Position Post-Split

- Frequently Asked Questions

- Conclusion

A Brief History of Tesla's Stock Splits

Tesla, Inc. has become synonymous with innovation and disruption in the automotive and energy sectors. Its stock market journey is no less remarkable, characterized by rapid growth and strategic moves, including stock splits. Understanding the history of Tesla's stock splits helps provide context for the tesla split buzz anticipated stock split in 2024.

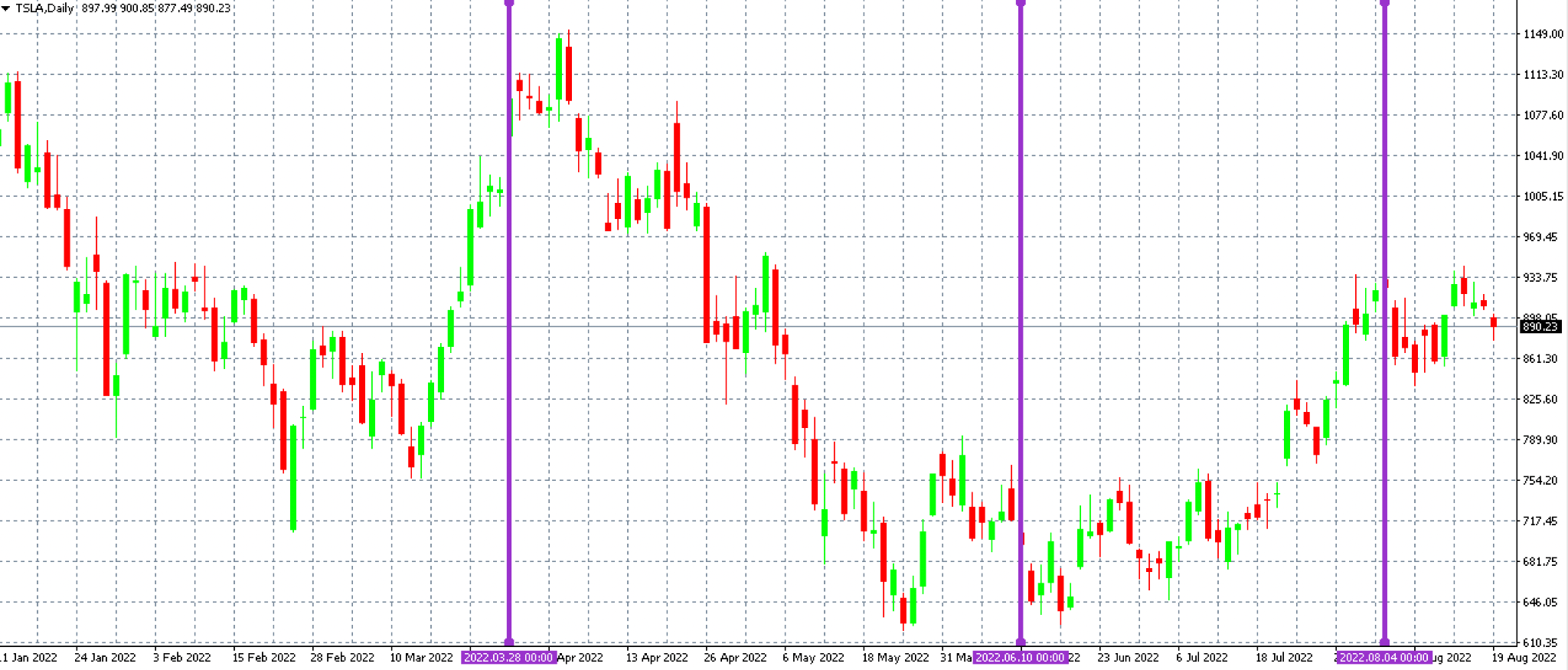

In August 2020, Tesla executed a 5-for-1 stock split, which was its first split since going public in 2010. This move came at a time when Tesla's stock price had soared, making it less accessible to retail investors. The split effectively reduced the share price while increasing the number of shares outstanding, making it easier for smaller investors to buy into the company.

The impact of the 2020 stock split was significant. Tesla's stock price surged in the weeks leading up to the split, and the momentum continued post-split, driven by increased investor interest and media coverage. The split also had psychological effects, as investors often perceive lower-priced shares as a buying opportunity, despite the fact that the intrinsic value of their holdings remains unchanged.

Looking back at Tesla's 2020 stock split, it's evident that the move was a strategic decision aimed at broadening the shareholder base. It also reflected Tesla's confidence in its ongoing growth and market position. As we consider the tesla split buzz anticipated stock split in 2024, these historical insights provide a valuable framework for understanding potential outcomes and motivations.

What is the Financial Impact of a Stock Split?

A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost liquidity. While the total value of shares remains unchanged, the number of shares increases, and the price per share decreases. But what does this mean for investors and the company?

For investors, stock splits can make shares more affordable, increasing accessibility for retail investors. This can result in a broader investor base and heightened interest in the stock. However, it's important to note that a stock split does not change the intrinsic value of an investor's holdings. It merely adjusts the share price and the number of shares held.

Read also:Meet Caleb Walker A Journey Of Dedication And Passion

From a company's perspective, a stock split can be a strategic move to enhance liquidity and attract more investors. By lowering the share price, the company can appeal to a larger audience, potentially leading to increased trading volume and market participation. This can be particularly beneficial for high-growth companies like Tesla, which rely on investor enthusiasm to fuel their expansion.

However, stock splits also come with challenges. They require administrative adjustments and can lead to increased volatility in the stock price. Additionally, if a company's fundamentals do not support continued growth, the initial post-split enthusiasm may wane, leading to potential price corrections. As we explore the tesla split buzz anticipated stock split in 2024, understanding these financial dynamics is crucial for investors and analysts alike.

How Do Stock Splits Affect Investor Sentiment?

Investor sentiment plays a pivotal role in the financial markets, influencing stock prices and market trends. Stock splits, such as the tesla split buzz anticipated stock split in 2024, can have a profound impact on investor sentiment, shaping perceptions and expectations.

Stock splits are often perceived as a positive signal, indicating that a company is performing well and expects continued growth. This perception can lead to increased investor confidence and heightened interest in the stock. The psychological effect of a lower share price can also encourage retail investors to enter the market, contributing to increased demand and potentially driving up the stock price.

Moreover, stock splits can generate media attention and public interest, further amplifying their impact on investor sentiment. For a high-profile company like Tesla, this media coverage can attract new investors and reinforce existing shareholder confidence. However, it's essential to recognize that stock splits do not change the fundamental value of a company. The initial enthusiasm may be tempered by broader market conditions and company performance.

As we consider the tesla split buzz anticipated stock split in 2024, it's important to assess how investor sentiment may evolve. Factors such as economic conditions, Tesla's financial performance, and market trends will influence how investors perceive and react to the split. Understanding these dynamics can help investors make informed decisions and navigate potential market volatility.

Why is Tesla Considering a Stock Split in 2024?

The tesla split buzz anticipated stock split in 2024 has sparked widespread speculation about the motivations behind Tesla's decision. Several factors may be driving this potential move, each contributing to the company's strategic vision and market positioning.

One possible reason for the anticipated stock split is Tesla's ongoing growth and success in the electric vehicle market. As the company continues to expand its product offerings and increase production capacity, its stock price has experienced significant appreciation. A stock split could make Tesla's shares more accessible to retail investors, broadening the shareholder base and increasing liquidity.

Additionally, Tesla may be considering a stock split to align with investor expectations and market trends. In recent years, several high-profile companies, including Apple and Nvidia, have executed stock splits, generating positive market reactions. By following suit, Tesla could capitalize on this trend and enhance its market appeal.

Furthermore, the tesla split buzz anticipated stock split in 2024 may reflect Elon Musk's vision for the company's future. As Tesla continues to innovate and disrupt the automotive industry, a stock split could serve as a signal of confidence in its growth trajectory. By making shares more accessible, Tesla can attract a diverse range of investors who share its commitment to sustainability and technological advancement.

While the exact motivations behind Tesla's anticipated stock split remain speculative, these factors provide insight into the company's strategic considerations. As we explore the potential outcomes of this move, it's essential to recognize the broader context and implications for Tesla and its investors.

How Might the Market React to Tesla's Stock Split?

Market reactions to stock splits can vary widely, influenced by factors such as investor sentiment, market conditions, and company performance. As we consider the tesla split buzz anticipated stock split in 2024, it's important to explore potential market reactions and their implications for Tesla and its investors.

Stock splits often generate positive market responses, as they are perceived as a sign of confidence and growth. The increased accessibility of shares can attract new investors, leading to heightened demand and potentially driving up the stock price. For a high-profile company like Tesla, media coverage and public interest can further amplify these effects.

However, market reactions to stock splits can also be influenced by broader economic conditions and market trends. In volatile or uncertain environments, investor sentiment may be tempered by caution, leading to more subdued reactions. Additionally, if a company's fundamentals do not support continued growth, the initial post-split enthusiasm may wane, leading to potential price corrections.

As we analyze the tesla split buzz anticipated stock split in 2024, it's essential to consider these factors and their potential impact on market dynamics. By understanding the variables that influence market reactions, investors can make informed decisions and navigate potential volatility effectively.

The Pros and Cons of Tesla's Stock Split

Like any corporate action, a stock split comes with its own set of advantages and disadvantages. As we examine the tesla split buzz anticipated stock split in 2024, it's crucial to weigh the pros and cons to understand its potential impact on Tesla and its investors.

Pros:

- Increased Accessibility: By lowering the share price, Tesla can make its stock more accessible to retail investors, broadening the shareholder base and increasing market participation.

- Enhanced Liquidity: A higher number of shares can lead to increased trading volume, improving liquidity and market efficiency.

- Positive Market Perception: Stock splits are often perceived as a sign of confidence and growth, boosting investor sentiment and attracting media attention.

Cons:

- Administrative Challenges: Stock splits require adjustments in share allocation and accounting, which can be complex and time-consuming.

- Potential Volatility: Stock splits can lead to increased volatility as investors react to the changes in share price and trading volume.

- No Intrinsic Value Change: While stock splits can enhance accessibility, they do not change the fundamental value of a company, and investors should be cautious of over-optimism.

As we consider the tesla split buzz anticipated stock split in 2024, it's important to understand these pros and cons to make informed investment decisions. By weighing the potential benefits and drawbacks, investors can navigate the complexities of the stock market and align their strategies with their financial goals.

A Guide for Investors: Navigating Tesla's Stock Split

For investors looking to navigate the tesla split buzz anticipated stock split in 2024, understanding the dynamics of stock splits is crucial. This guide provides key insights and strategies to help investors make informed decisions and manage potential risks.

Understand the Basics: A stock split increases the number of shares while reducing the share price, without changing the overall value of an investment. It's important to recognize that stock splits do not alter a company's fundamentals.

Assess Market Conditions: Before making investment decisions, consider broader market conditions and trends. Stock splits can be influenced by economic factors, industry dynamics, and investor sentiment.

Analyze Company Performance: Evaluate Tesla's financial performance and growth prospects. Strong fundamentals can support continued growth, while potential challenges may impact future performance.

Consider Long-Term Goals: Align investment strategies with long-term financial goals. Stock splits can provide opportunities for growth, but it's important to maintain a diversified portfolio and manage risk effectively.

Monitor Market Reactions: Stay informed about market reactions and investor sentiment. Stock splits can lead to increased volatility, and understanding market dynamics can help investors navigate potential fluctuations.

By following these guidelines, investors can navigate the complexities of the tesla split buzz anticipated stock split in 2024 and make informed decisions that align with their financial objectives.

Analyzing Historical Stock Splits: Lessons from Tesla

Historical analysis of stock splits provides valuable insights into their potential impact and outcomes. As we explore the tesla split buzz anticipated stock split in 2024, examining Tesla's past stock splits and their effects can offer important lessons for investors and analysts.

Tesla's 2020 stock split was a significant event that demonstrated the potential benefits and challenges of such corporate actions. The split resulted in increased accessibility for retail investors, heightened demand, and a surge in stock price. However, it also highlighted the importance of managing investor expectations and market dynamics.

One key lesson from Tesla's 2020 stock split is the importance of aligning stock splits with strong company performance and growth prospects. A company's fundamentals should support continued growth to sustain investor interest and market momentum post-split.

Additionally, historical analysis underscores the significance of market conditions and investor sentiment in shaping stock split outcomes. Economic environments, industry trends, and psychological factors can all influence market reactions and investor behavior.

As we consider the tesla split buzz anticipated stock split in 2024, these historical insights provide a valuable framework for understanding potential outcomes and navigating the complexities of the stock market.

What Do Experts Say About Tesla's Stock Split?

Expert opinions on the tesla split buzz anticipated stock split in 2024 provide valuable insights into its potential impact and implications. As industry analysts and financial professionals weigh in on Tesla's decision, their perspectives can help investors make informed decisions and navigate market dynamics.

Many experts view Tesla's anticipated stock split as a strategic move to enhance accessibility and liquidity. By lowering the share price, Tesla can attract a broader range of investors, increasing market participation and trading volume. This can be particularly beneficial for high-growth companies like Tesla, which rely on investor enthusiasm to fuel expansion.

However, experts also caution against over-optimism, emphasizing the importance of evaluating Tesla's fundamentals and market conditions. Stock splits do not change the intrinsic value of a company, and their success depends on sustained growth and performance.

Overall, expert opinions highlight the potential benefits and challenges of the tesla split buzz anticipated stock split in 2024, providing valuable guidance for investors and analysts. By considering these perspectives, stakeholders can make informed decisions and align their strategies with their financial goals.

How Does Tesla's Stock Split Compare to Other Companies?

Comparing Tesla's anticipated stock split to those of other companies provides valuable context and insights into its potential impact and outcomes. As we explore the tesla split buzz anticipated stock split in 2024, examining similar corporate actions by other industry leaders can offer important lessons and perspectives.

Several high-profile companies, including Apple and Nvidia, have executed stock splits in recent years, generating positive market reactions. These companies leveraged stock splits to enhance accessibility and liquidity, attracting new investors and boosting demand. Their success underscores the importance of aligning stock splits with strong company performance and growth prospects.

However, not all stock splits yield positive outcomes. Some companies may experience increased volatility or price corrections if their fundamentals do not support continued growth. This highlights the significance of managing investor expectations and market dynamics.

As we analyze the tesla split buzz anticipated stock split in 2024, comparing it to similar corporate actions by other companies provides valuable insights into potential outcomes and strategies. By understanding these dynamics, investors can make informed decisions and navigate the complexities of the stock market.

Future Projections: Tesla's Market Position Post-Split

As we consider the tesla split buzz anticipated stock split in 2024, future projections for Tesla's market position provide valuable insights into its potential impact and implications. By examining factors such as market trends, company performance, and investor sentiment, we can explore potential outcomes and strategies for Tesla and its stakeholders.

Tesla's ongoing growth and success in the electric vehicle market position it as a leader in innovation and sustainability. The anticipated stock split could enhance accessibility and liquidity, attracting new investors and increasing market participation. This could further strengthen Tesla's market position and support its growth trajectory.

However, future projections also depend on broader market conditions and industry dynamics. Economic environments, technological advancements, and regulatory developments can all influence Tesla's market position and performance post-split.

As we analyze the tesla split buzz anticipated stock split in 2024, these future projections provide valuable context and insights into potential outcomes and strategies. By understanding these dynamics, stakeholders can make informed decisions and align their strategies with their financial goals.

Frequently Asked Questions

- What is a stock split, and how does it work?

A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost liquidity. The total value of shares remains unchanged, but the number of shares increases, and the price per share decreases. - Why is Tesla considering a stock split in 2024?

Tesla may be considering a stock split to increase accessibility for retail investors, enhance liquidity, and align with market trends. It may also reflect confidence in its growth trajectory and market position. - How can investors navigate Tesla's stock split?

Investors can navigate Tesla's stock split by understanding the basics of stock splits, assessing market conditions, analyzing company performance, considering long-term goals, and monitoring market reactions. - What are the pros and cons of Tesla's stock split?

The pros of Tesla's stock split include increased accessibility, enhanced liquidity, and positive market perception. The cons include administrative challenges, potential volatility, and no change in intrinsic value. - How do stock splits affect investor sentiment?

Stock splits can positively impact investor sentiment by signaling confidence and growth. They can attract new investors and generate media attention, but it's important to recognize that they do not change a company's fundamentals. - What are the potential market reactions to Tesla's stock split?

Market reactions to Tesla's stock split can vary based on factors such as investor sentiment, market conditions, and company performance. Increased accessibility and liquidity can lead to positive reactions, but broader economic factors may influence outcomes.

Conclusion

As we explore the tesla split buzz anticipated stock split in 2024, it's clear that this corporate action is surrounded by excitement and speculation. Tesla's previous stock splits have demonstrated the potential benefits and challenges of such moves, providing valuable insights for investors and analysts.

The anticipated stock split reflects Tesla's ongoing growth and success in the electric vehicle market, positioning it as a leader in innovation and sustainability. By enhancing accessibility and liquidity, Tesla can attract new investors and strengthen its market position.

However, it's important to recognize that stock splits do not change a company's fundamentals. Investors should assess Tesla's financial performance, market conditions, and industry dynamics to make informed decisions and navigate potential risks.

Overall, the tesla split buzz anticipated stock split in 2024 offers exciting opportunities and challenges for Tesla and its stakeholders. By understanding the dynamics of stock splits and aligning strategies with long-term financial goals, investors can effectively navigate the complexities of the stock market and capitalize on potential growth.

For further insights and analysis on stock splits and market trends, consider exploring resources from reputable financial institutions and industry experts.